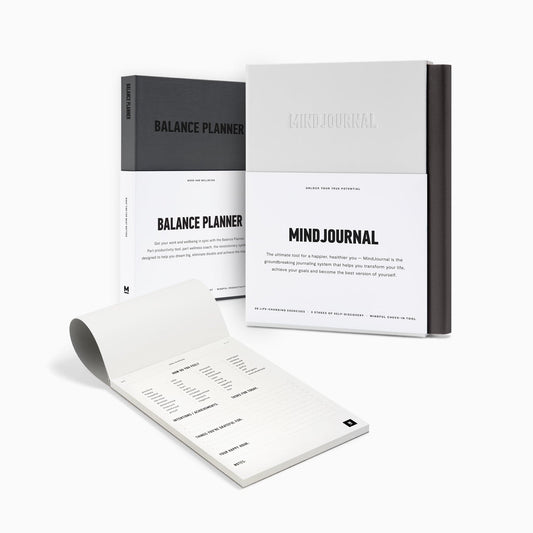

Start your journey

Browse our bestsellers for a better you.

Frequently added:

by MindJournal - 11 min read

Money’s a funny thing. We’d probably all like more of it. And, given the current economic climate, we’ve probably all spent more time feeling unsure about it than we’d like to.

Rising prices are having an impact on the mental wellbeing of millions worldwide. In fact, 8/10 Britons (78%) say money worries are affecting their mental health - whilst over half of the Americans asked are feeling the strain.

But you can't control the cost of living - so what can you do?

How we feel about money largely depends on how we’ve grown up. Your family might have been financially conservative, so you may now feel the same or have gone in the opposite direction and are a bit freer with your cash than you mean to be.

Or maybe your friends have high-earning jobs, and you feel pressure to keep up.

Whatever your current relationship with money, there’s nothing to stop you changing it if you want to.

Whether you’re looking to save, plan for the future, or have more cash to do the things you enjoy, our financial experts have some on-the-money advice to help you achieve a better, more productive relationship with your finances.

Everyone's financial situation is different, but no matter your circumstances, financial wellbeing (whatever it looks like for you) should be at the top of your list.

“Although as a society we don’t like to talk about it, money impacts every facet of our lives and, by virtue of that, our wellbeing,” says Ellie Austin-Williams, founder of This Girl Talks Money.

One study found “higher financial worries were significantly associated with higher psychological distress”. Meanwhile, other research found employees with money worries are 50% more likely to report signs of poor mental health.

“A negative relationship with money means feeling powerless, which results in financial shame, anxiety, sinking into debt, and other bad financial experiences,” adds Bill Ryze, a chartered financial consultant at fiona.com. “With increased stress levels, you can barely rest enough, so you are likely to experience sleep problems and headaches, too.”

All of which sounds pretty gloomy, right? But the good news is that there are steps you can take to improve your financial wellbeing.

The first thing to remember, is that nothing is permanent. With some smart work, you can make positive changes to your situation and reap the benefits.

“Cultivating a positive relationship with money and spending can benefit our wellbeing,” explains Jonathan Merry, CEO of moneyzine.com. “When we have a healthy attitude towards money, we can make informed financial decisions, set and achieve financial goals, and maintain a balanced approach to spending and saving.”

“A positive relationship with money allows us to feel more in control of our financial circumstances, which can reduce stress, enhance our mental wellbeing, and contribute to a greater sense of overall contentment and happiness,” Merry adds.

According to one study, taking financial control plays a “protective role for complete wellbeing”. In other words, you’ve everything to gain.

Reworking your relationship with your finances should be well-thought-out, but it shouldn't be restrictive. We all need that occasional treat or caffeine boost, after all. Don't underestimate the power of those little moments of joy.

Here, our experts suggest their top money tips to help you improve your bank balance and as a result, your overall health and happiness.

All three of our experts point to understanding your current financial situation as the first step to change. “Know where you are right now financially,” says Williams. “Knowledge is power, and without a clear idea of your financial picture (your income, expenses, savings and debt etc.), trying to improve your circumstances is like taking a stab in the dark. Give yourself the power.” It can be tempting to bury your head in the sand, but by being honest with yourself you are already in a better situation than you were before.

TikTok has long been known as the home of the side hustle - especially for Gen Z. However, a new wave of TikTokers is using the platform to promote ways to combat the cost of living. One of which is Seema Sheth @bobeema, creator of the '30-day financial cleanse'. One of her recommendations is to:-

Sheth found she'd been subscribed to Kindle Premium for months and never actually used it, creating a loss of nearly £70.

Remember: this isn't about stripping your life of everything you love. It's just about ensuring you only pay for what you use or things that bring you joy.

If you can, “a good rule of thumb is to apply the 50/30/20 rule to your income,” advises Merry. This means that: 50% goes towards necessities like housing and food, 30% goes towards ‘wants’ like going out or your gym membership and the final 20% goes into savings.

Following on from that, Williams suggests creating a ‘fun budget’, an amount of money to allow you to make spontaneous decisions. “For some, that’ll be £10 a week; for others, £100. The amount doesn’t matter, but the aim is to allow some flex in your finances so you don’t feel too restricted.”

Ryze agrees that saving shouldn’t be limiting, and in fact, we need to rethink our relationship with money entirely. “Do not feel guilty spending,” he says. “Everyone tells you to save more, advice that has resulted in a scarcity mentality, which is unhealthy and leads to hoarding. A healthy relationship with money means you do not feel guilty about meeting your basic needs before saving.”

“A good way to do this is to try to keep a list of things you want to buy on impulse. If it still looks like a good idea after a few days (or weeks), then you can probably rest assured that it’ll bring you joy,” adds Merry.

“A financial safety net can provide peace of mind during unexpected events or emergencies,” says Merry. If you can, “Start by saving a small portion of your income regularly and gradually increase the amount over time.”

“Define short-term and long-term financial goals that align with your values and priorities,” Merry suggests. “Do you want to get out of the renting cycle and buy your own home? You’ll need a plan to get there. This can provide a sense of purpose and motivation in managing your finances.” If you find the idea of this overwhelming, take a look at our SMART guide to setting goals.

In Britain alone, over a fifth of adults (21%) have never discussed money with a friend or family member.

"We need to come together as a group of friends - no judgment, no shame," says Banking Executive Thasunda Duckett in her TED talk.

Williams agrees, "Start talking about money with people around you," she advises. "It might feel awkward, to begin with, but it's one of the best things you can do for your financial wellbeing. You will find you learn and get support when you open up."

By doing so, you'll realise other people are in the same boat - or worrying about similar things. Not only that, it's a good way to rationalise the situation so you can start building a plan. Just keep it simple and take it one step at a time.

If your financial worries are impacting your daily life, it may be time to reach out for support. Whether it's seeking guidance from financial advisors, consulting with community organisations, or reaching out to supportive friends and family, remember that you don't have to face financial difficulties alone. Help is just a step away. We've put some resources into our wellbeing hub here.

"Finances are a common stress for people, but working on your relationship with money will improve your physical, mental, and social wellbeing," says Ryze.

As the tips above show, by thinking a little bit more about how we spend money – and by not seeing spending as something 'bad' – we can start to plan our financial future, speaking with friends, family and even organisations to gain support along the way.

But, as Ryze also explains, achieving a good relationship with money is an ongoing process which takes dedication. Be kind and patient with yourself – like anything worth doing, refiguring your finances can take time. In the meantime, an occasional splurge might just be a great reward for all of your good work so far.